Life is Full of Priorities

Whether it’s securing a comfortable retirement, paying for a child’s education or purchasing a second home, we all have competing short- and long-term goals that require a personalized plan to be successful. With sound planning, we can all get a little more out of life – spending more time focused on what’s important to us and less time being concerned about finances.

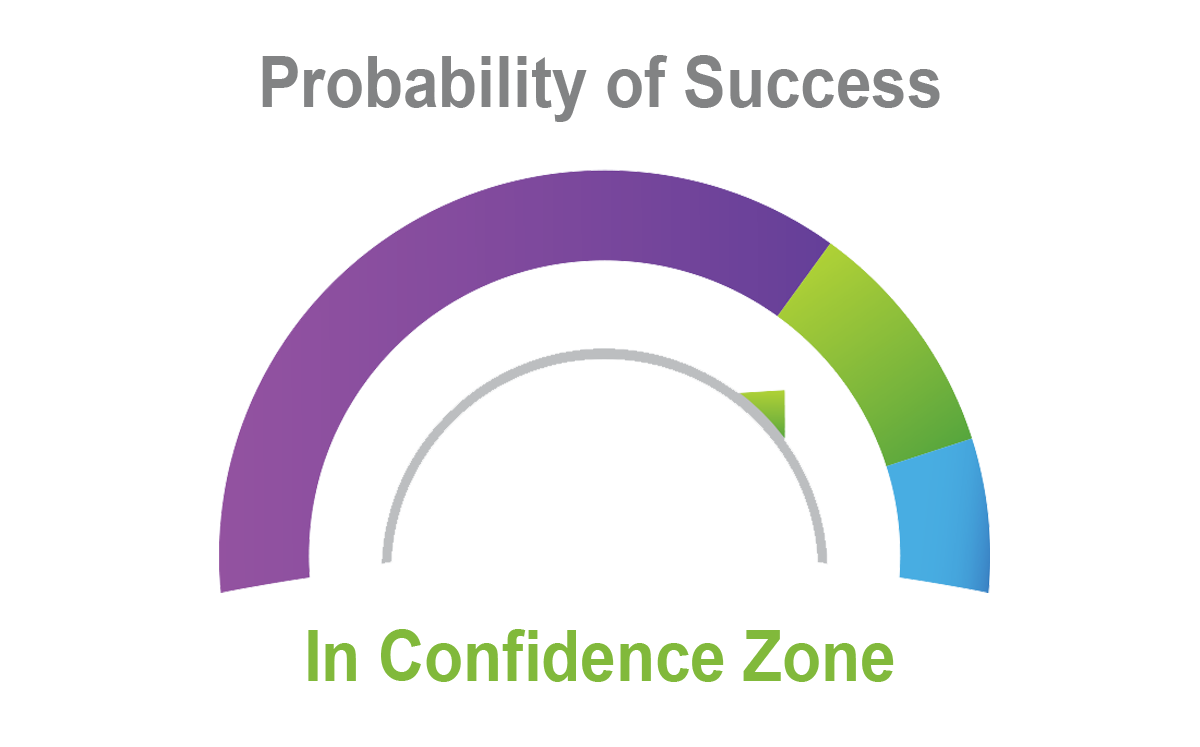

Our mission is to make financial planning an easy, informative, and engaging process for clients. With innovative and collaborative planning tools, we can help you create a realistic plan designed to pursue your goals. Once we have a baseline plan, we’ll thoroughly test the plan and gauge the probability it will be successful, discuss priorities, and look at tradeoffs that can be made to attempt to improve your odds.

Goal Planning & Monitoring

Goal Planning & Monitoring is designed to put you in control of your future. Along with one of our financial advisors, you can develop a plan that will help you visualize your future so you can enjoy the wealth you’ve worked hard to build. Together, you and your advisor can create a customized goal plan, test adjustments in real time and predict your retirement readiness – making sure you’re in the “green zone.”

Steps to Creating Your Plan and Getting Results

-

1. Goal Creation

The planning process starts with a question: What does your ideal retirement look like? Allow yourself to dream a little. Think of how much you would like to spend on things such as travel, charity, home improvements or even a new car.

-

2. Identify Resources

You’ll get a better understanding of your overall financial picture with the ability to view your income and assets – the foundation of your plan and the key to achieving your goals – in one place. Navigating complex resources such as Social Security is made easier with tools like the Social Security Analysis.

-

3. You and the Market

Understanding how the markets work and your comfort with taking risk is the key to a successful plan. Your advisor can use the software to help you understand your tolerance for risk, explaining market cycles and helping you identify scenarios that might cause you to rethink your long-term investment strategy.

-

4. Getting Results

The main goal of your plan is to get you into the “confidence zone” or “green zone,” the optimal financial position for achieving your goals, and to keep you there over time.

Discover Your Risk Tolerance

Taking a risk assessment is an effective way to measure your willingness and capacity for risk. It is a critical component of the investment process.